When issuing invoices with InvoiceOnline.com, the user can choose from several types. One of them is also a corrective tax document.

Corrective tax document with InvoiceOnline.com

Previously, two terms were used for a correcting (tax) document - credit note and debit note. This type of invoice can also be issued with InvoiceOnline.com.

For non-payers of VAT, it is not a tax document.

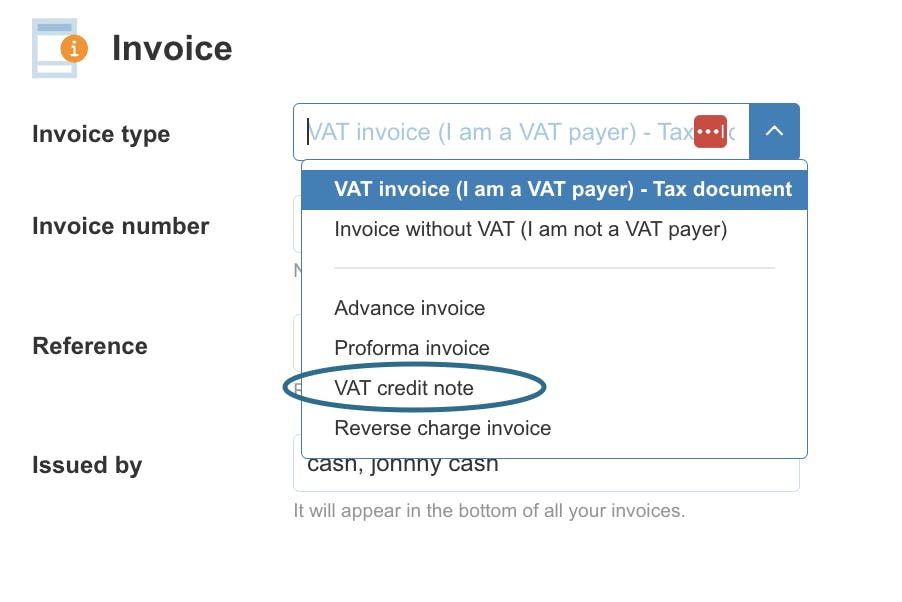

For VAT payers, if a corrective tax document needs to be issued, the procedure is through the option of selecting the type of invoice: Credit note template.

When creating this type of invoice, the following must be observed:

- Indicate in the note the reason for the reduction/increase/adjustment of the price or tax value,

- Have the same supplier and customer as on the original invoice,

- Keep the original variable symbol of the invoice.

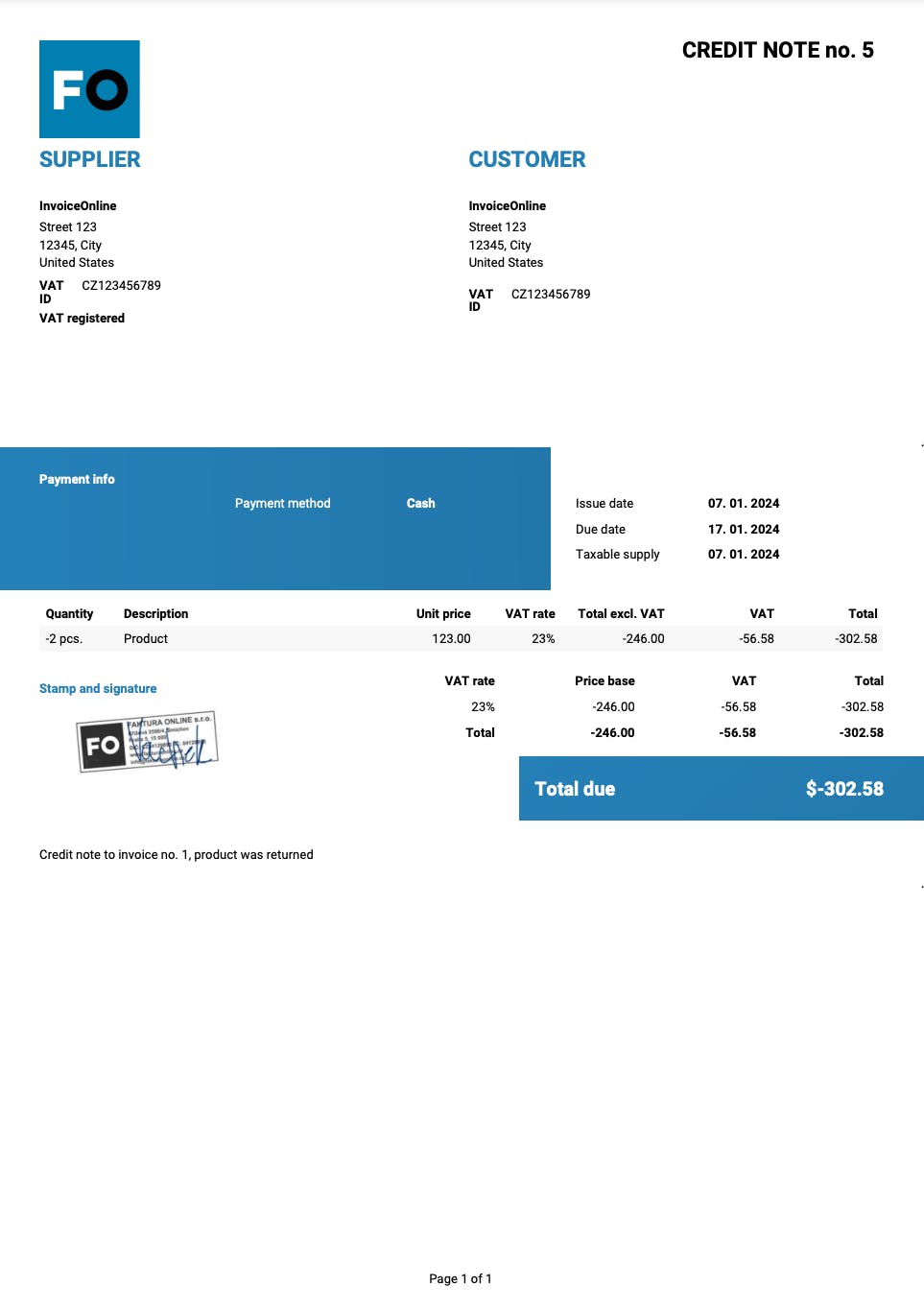

Corrective tax document template